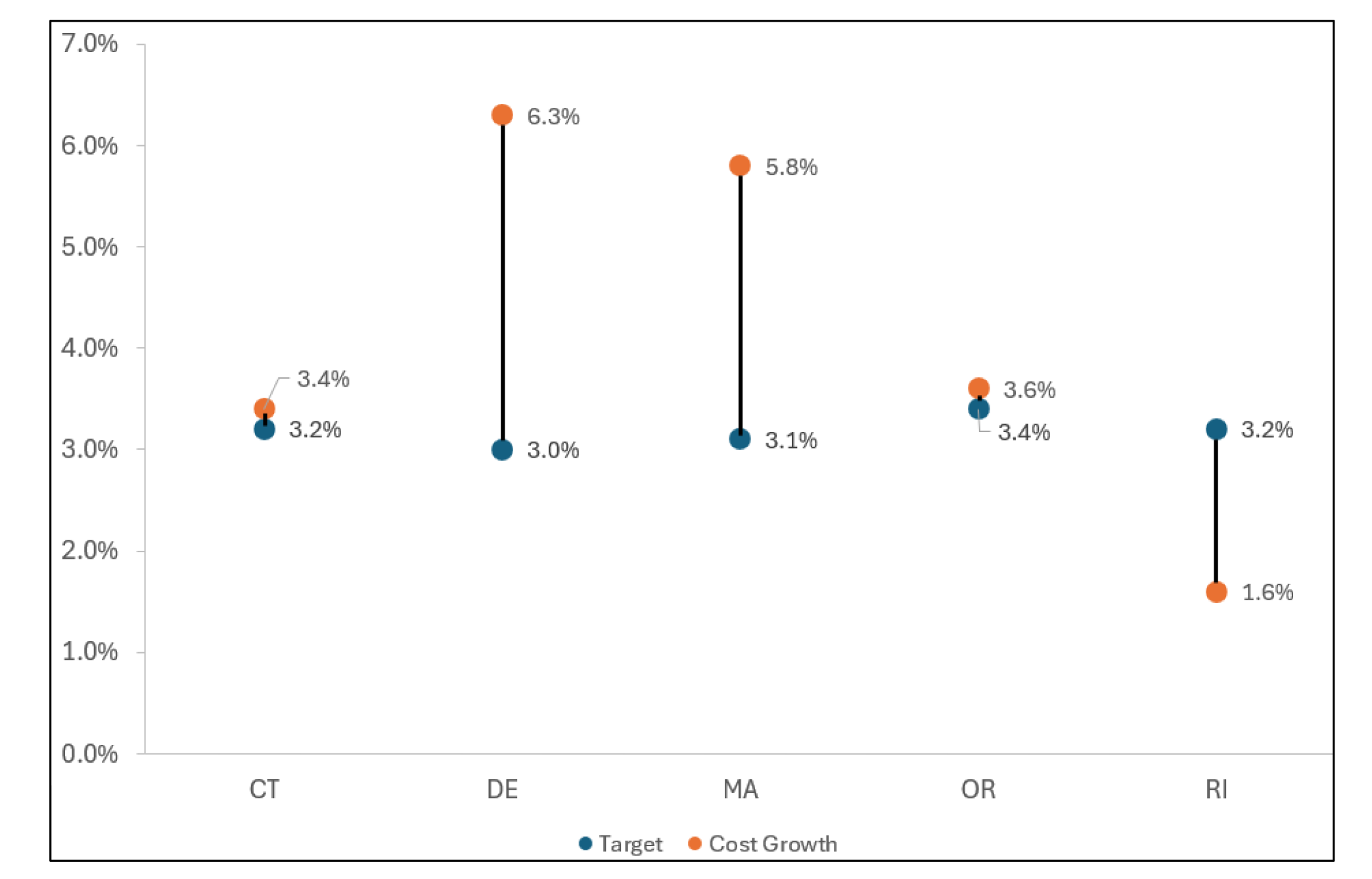

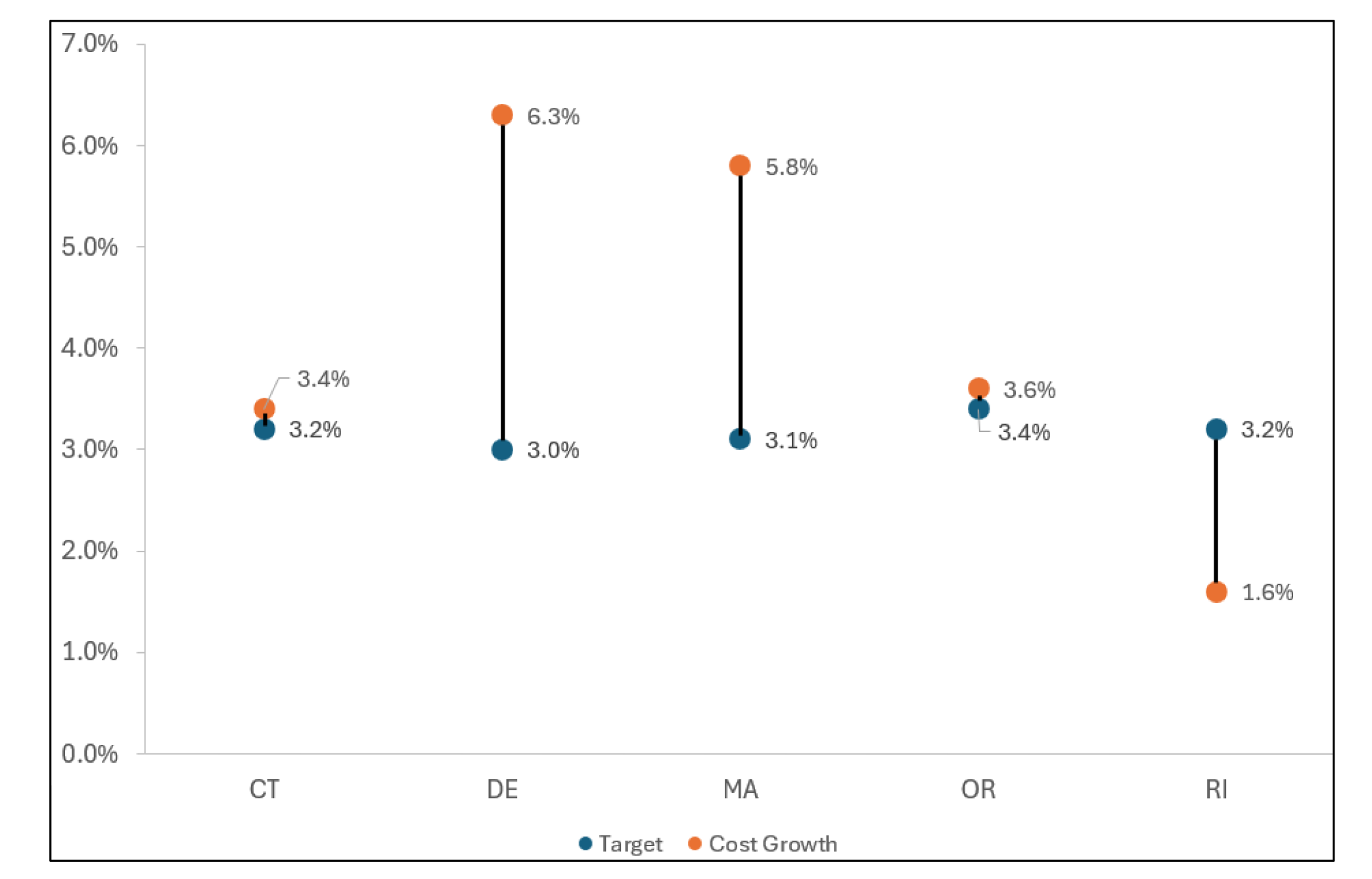

Exhibit 1: State spending growth and spending growth targets, 2022

Source: Authors’ analysis of publicly reported data from Connecticut, Delaware, Massachusetts, Oregon, and Rhode Island.

Jessica Mar, January Angeles

August 8, 2024 - Health Affairs

As of mid-2024, eight states have committed to a process to slow spending growth by establishing statewide targets for health care spending growth. This spring, five of them - Connecticut, Delaware, Massachusetts, Oregon, and Rhode Island}ublicly shared their 2022 performance against their statewide spending targets. These comprehensive spending data sets are a key element of these states’ efforts to rein in overall health spending growth. They are unique in that they include aggregate data from commercial, Medicaid, and Medicare Advantage payers for all state residents. This differs from other data sources that are available at the state level, which are granular and may not capture the state’s entire population nor non-claims transactions.

In this article, we examine 2022 health care spending trends in these states and the factors that influenced these patterns. In short, we find that spending growth moderated in 2022, compared to 2021, but still exceeded targets in four out of the five states.

As shown in exhibit 1, for 2022, these states set their spending targets between 3.0 percent and 3.4 percent. As in 2021, Rhode Island was the only state to meet its spending growth target of 3.2 percent; it had the lowest rate of spending growth at 1.6 percent. Oregon’s 2022 spending grew 3.6 percent, only slightly exceeding its 3.4 percent target. Connecticut also slightly exceeded its 3.2 percent target with spending growth at 3.4 percent. Meanwhile, Delaware and Massachusetts significantly exceeded their targets with 2022 spending growth of 6.3 percent and 5.8 percent, respectively.

Exhibit 1: State spending growth and spending growth targets, 2022

Source: Authors’ analysis of publicly reported data from Connecticut, Delaware, Massachusetts, Oregon, and Rhode Island.

Even though most states did not meet their target, spending growth was much lower in 2022 compared to 2021 (exhibit 2). Accordingly, as states did not reset their targets from 2021 to 2022, the margin by which states exceeded their targets was higher in 2021 (about 3 to 8 percentage points as people sought care that they put off in 2020), compared 2022 (topping out at 3.6 percentage points).

Exhibit 2: Statewide spending growth, 2021 and 2022

Source: Authors’ analysis of publicly reported data from Connecticut, Delaware, Massachusetts, Oregon, and Rhode Island.

Delaware’s 2021 spending growth was highest at 11.2 percent, followed by Massachusetts at 9.0 percent. This growth has since moderated, and spending increases in 2022 largely mirrored pre-pandemic levels『hile still continuing to exceed targets. While Delaware and Massachusetts continued to have the highest spending increases, their 2022 spending growth was much lower than 2021 at 6.3 percent and 5.8 percent, respectively.

In 2022, retail prescription drugs was the fastest-growing spending category in Connecticut, Delaware, and Massachusetts, and the second fastest in Oregon and Rhode Island (behind Hospital Outpatient and Professional Other [for example, behavioral health] services, respectively). Delaware and Massachusetts experienced double-digit increases in prescription drug spending at 19.0 percent and 10.5 percent, respectively. In Connecticut, prescription drug spending rose 9 percent. Oregon and Rhode Island had significantly lower growth∥bout 3 percent and 5 percent, respectively(n prescription drug spending compared to the other three states. More detailed analyses from Rhode Island and Connecticut show that in 2022, increases in both unit payment and in use contributed to the growth in prescription drug spending in 2022.

The underlying reasons for the state variation in growth rates are unclear. What is clear, however, is that prescription drugs’ rank as the service category with the greatest growth in 2022 is mirrored in commercial markets at the national level; from 2021 to 2022, spending on prescription drugs grew 11.8 percent, while other categories’ spending grew between 1.0 percent and 5.0 percent, or decreased. At the national level, spending growth on prescription drugs was driven by increases in both unit payments (7.9 percent) and use (3.6 percent).

Compared to both overall spending and prescription drug spending, hospital inpatient spending showed opposite trends in 2022, dropping in four states and remaining flat in one. Spending in this category dropped the most in Rhode Island, by 6.6 percent. It decreased 3.7 percent in Connecticut and 4.3 percent in Oregon. In Massachusetts and Delaware, spending remained relatively flat, with changes in spending at -2.2 percent and 0.4 percent, respectively. While spending on inpatient services decreased, spending on outpatient services increased or stayed flat. Connecticut, Massachusetts, Oregon, and Rhode Island each saw spending on outpatient services increase between 3.0 percent and 5.5 percent, while Delaware’s spending remained steady, with growth at 0.3 percent. These patterns are consistent with national commercial trends(n 2022, spending on inpatient services decreased by 5.9 percent, while spending on outpatient services increased 4.6 percent.

The moderate spending growth seen in 2022 is likely to be a fleeting phenomenon. The significant reimbursement increases that health care providers sought in their contract negotiations with health insurers following the period of high inflation in late 2021 through 2022 are likely to play out in the form of high spending growth in both 2023 and 2024. We have already seen premium jumps for commercial health insurance coverage nationally, with some states experiencing premium increases of more than 10.0 percent in 2024, even as wages have only grown 3.9 percent.

As states across the nation move forward with efforts to improve affordability by reining in health care spending growth, they face stiff resistance from the pharmaceutical and hospital industries. For example, in Oregon, where the state agency overseeing the spending growth target program has the authority to financially penalize providers that repeatedly exceed the target, the hospital association has sought to weaken the state’s accountability mechanisms by suggesting maximums for these penalties. In Connecticut, when the Office of Strategy called on three pharmaceutical manufacturers (Abbvie, Amgen, and Vertex) to appear at its public hearing in June, all three refused.

Yet, the results from the most recent cost growth target data collection underscore the need for states to continue to move this work forward. Now that these states have collected and analyzed several years of data to understand the drivers of health care spending and spending growth, the focus must turn to implementing policies that address high and rising spending and make health care more affordable.

During the 2024 state legislative sessions, two states took action, informed in part by recent spending growth that exceeded their cost growth targets. Delaware passed a bill that creates a hospital cost review board, which will be charged with reviewing and approving annual hospital budgets. Under this new legislation, hospitals will need to meet the state’s budget benchmark for cost increases. In Massachusetts, lawmakers put forth that calls for, among many other things: increasing enforcement related to the state’s cost growth target; establishing a dedicated Division of Health Insurance, which would be reasonable for developing a set of affordability standards; and strengthening oversight of hospital systems and other entities. With state insurance departments receiving high increases in their 2025 commercial rate submissions in many states, continuing state action to slow spending growth seems certain.

Jessica Mar and January Angeles are employees of Bailit Health Purchasing, LLC (Bailit Health), which provides consultancy services to states, including to four states studied, Connecticut, Massachusetts, Oregon, and Rhode Island. The authors thank the Connecticut Office of Health Strategy, Delaware Health Care Commission, Massachusetts Health Policy Commission, Oregon Health Authority, and the Rhode Island Office of the Health Insurance Commissioner for contributing their cost growth target data for this article. This work is supported by funding from the Peterson-Milbank Program for Sustainable Health Care Costs.